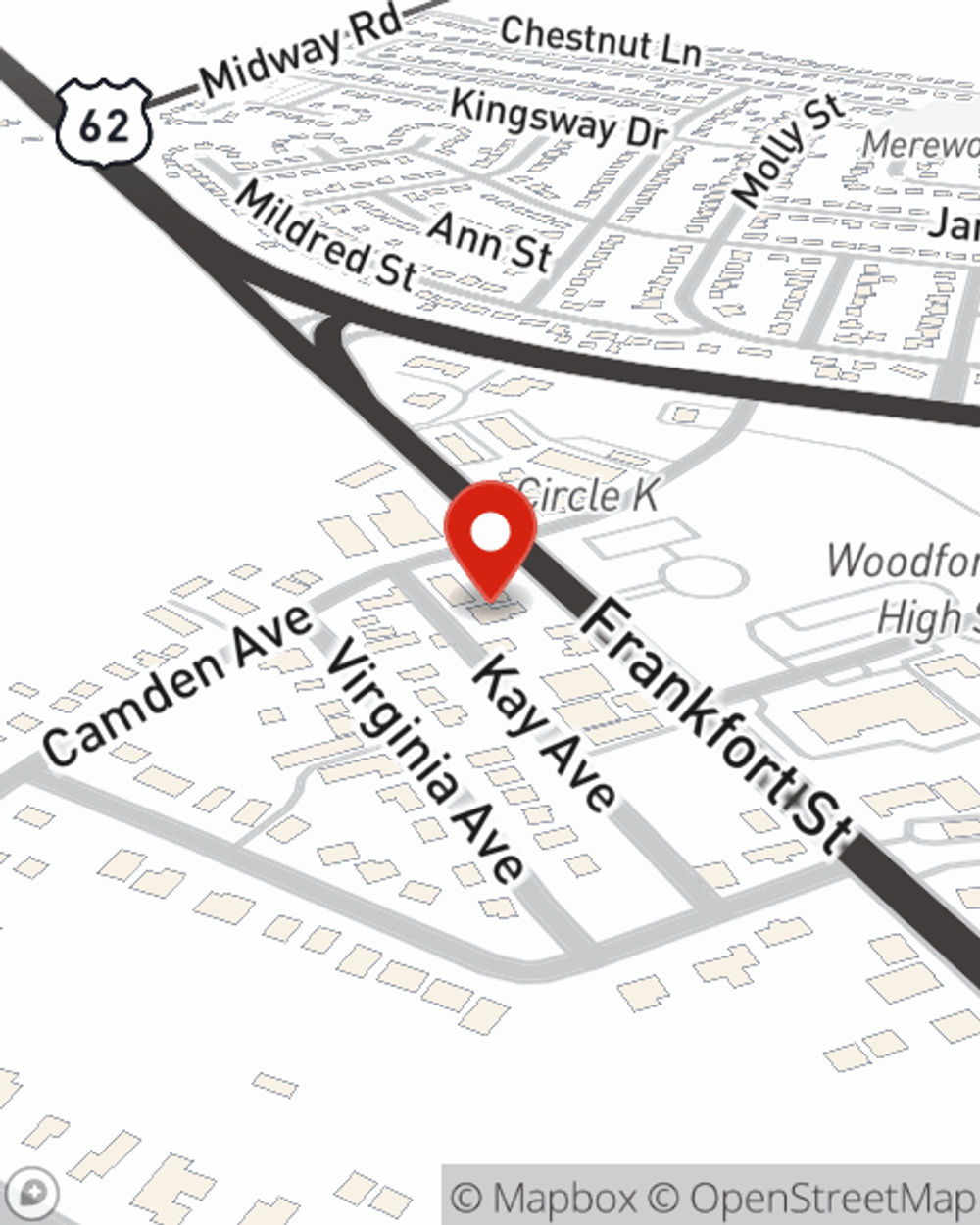

Business Insurance in and around Versailles

Get your Versailles business covered, right here!

Almost 100 years of helping small businesses

- Georgetown

- Nicholasville

- Frankfort

- Midway

- Lawrenceburg

- Winchester

- Richmond

- Harrodsburg

- Danville

- Berea

- Paris

- Cynthiana

- Central Kentucky

- 40383

- 40347

- 40503

- 40509

- 40502

- 40513

- 40514

- 40356

- 40330

- 40601

- Woodford County

Help Prepare Your Business For The Unexpected.

As a small business owner, you understand that sometimes the unpredictable is unavoidable. Unfortunately, sometimes problems like an employee getting hurt can happen on your business's property.

Get your Versailles business covered, right here!

Almost 100 years of helping small businesses

Protect Your Future With State Farm

With State Farm small business insurance, you can give yourself more protection! State Farm agent Jason Goh is ready to help you handle the unexpected with reliable coverage for all your business insurance needs. Such attentive service is what sets State Farm apart from other business insurance providers. And it won’t stop once your policy is signed. If the unexpected happens, Jason Goh can help you file your claim. Keep your business protected and growing strong with State Farm!

Intrigued enough to research the specific options that may be right for you and your small business? Simply call or email State Farm agent Jason Goh today!

Simple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Jason Goh

State Farm® Insurance AgentSimple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.